Top 12 Supply Chain Trends: What You Should Know About Logisitics in 2023

Supply chain management trends in 2023 will be influenced by numerous factors, from technology and economics to world events. Here's what we expect to be a hot topic for the global supply chain industry in the coming months

The 2020s has been an exciting, challenging and historic era for supply chains around the world so far, and while almost all factors point to 2023 being somewhat more "normal", the industry continues to evolve and grow. Let's take a look at what supply chain managers need to pay attention to in 2023.

Most supply chain management professionals have spent the last two years trying to survive one supply chain crisis after another. Decisions were made out of necessity, based on what was available. But now that the industry is rebalancing, the trick will be to not overreact when things change. In 2023, try not to hit the panic button too quickly and keep your long-term goals and trends in mind when making decisions.

Businesses will shift from survival mode to growth mode

One of the most promising trends for 2023: a continuation of the downward trend in carrier rates. In the midst of the pandemic, consumer spending on goods skyrocketed and throughput shrank. As a result, carriers have increased fares for both sea and land transport, and service levels have deteriorated as labor shortages and lockdowns have caused delays in travel. Shippers had little choice but to deal with delays and other issues. As demand has leveled off, capacity has increased and backlogs have decreased, this trend has begun to reverse and we expect industry balance to continue for some time in 2023, in addition to declining overall transportation costs

Carriers will reduce tariffs and improve service

One factor contributing to the disruption of transport chains was the unprecedented levels of congestion that hit major ports around the world. Although the US West Coast ports were the main focus, most of the major US East Coast and European ports were also affected. The capacity of ships and containers moored in congested US and European ports meant there was a corresponding shortage in ports of departure throughout Asia, making it a global phenomenon. A study of congestion levels in 2022, as well as flight schedules published by container carriers, makes it unlikely that any reduction in congestion levels will occur in 2023.

Congestion in ports

While some companies have increased inventories, others have taken a different approach to dealing with supply chain problems caused by the pandemic. Many of our customers have relocated or relocated their production, moving their process from Asia to the United States, Mexico or another neighboring country. This practice can have both advantages and disadvantages; production in the United States and Mexico is often more expensive than in Asia, but delivery times are much shorter. Reshoring or short-range shoring of supply chain components can also bypass any potential problems caused by shortages and backlogs. We expect to see more offshore companies next year.

Reshoring and nearshoring

Digitalization and new developments in the field of artificial intelligence, blockchain, IoT and automation are becoming increasingly relevant for maritime transport. They help streamline existing processes, create new business opportunities, and transform supply chains and trade geography.

Visibility describes the ability of supply chain managers to track goods and shipments throughout the entire supply chain process, from raw material sourcing and transportation to production and distribution. And for good reason: supply chain data and transparency can benefit almost every aspect of a business, including customer satisfaction and bottom line improvement. The best control software solutions also integrate multiple management systems such as warehouse management systems and enterprise resource planning tools. These integrations can eliminate manual processes (and the possibility of human error) to improve efficiency and accuracy. Technologies that prioritize data and transparency will be incredibly in demand in 2023. as the implementation of strategic technologies can enable supply chain managers to streamline supply chains from end to end. Digitization is also becoming more common as telecom operators and even government agencies begin to require electronic documents. As a historical paper industry, these industry trends will force companies to prioritize digital transformation.

Visibility describes the ability of supply chain managers to track goods and shipments throughout the entire supply chain process, from raw material sourcing and transportation to production and distribution. And for good reason: supply chain data and transparency can benefit almost every aspect of a business, including customer satisfaction and bottom line improvement. The best control software solutions also integrate multiple management systems such as warehouse management systems and enterprise resource planning tools. These integrations can eliminate manual processes (and the possibility of human error) to improve efficiency and accuracy. Technologies that prioritize data and transparency will be incredibly in demand in 2023. as the implementation of strategic technologies can enable supply chain managers to streamline supply chains from end to end. Digitization is also becoming more common as telecom operators and even government agencies begin to require electronic documents. As a historical paper industry, these industry trends will force companies to prioritize digital transformation.

Visibility, data, and digitization

Of course, geopolitics has influenced supply chains for centuries. But in recent months, international politics and current events have come to the fore in conversations about the supply chain. A Russo-Ukrainian war could disrupt supply chains around the world for as long as it continues. Meanwhile, any change in trade relations between China and the United States could fundamentally change the US import landscape.

Geopolitics will continue to influence supply chains

If you've looked at the homepage of Supply Chain Dive, Freight Waves, Supply Chain Management Review, or any other leading industry publication this year, you probably expect things like autonomous trucks, drone delivery, and warehouse robotics to be at the very top. center of attention. corner. And for select companies they can be. But in fact, such technology has yet to pass before it becomes mainstream.

Advanced tech

As with other industries, cybersecurity is a growing concern in supply chain management. Modern technologies can add vulnerabilities to the ships especially if there are insecure designs of networks and uncontrolled access to the internet. Additionally, shoreside and onboard personnel may be unaware how some equipment manufacturers and software providers maintain remote access to shipboard equipment and its network system. Unknown, and uncoordinated remote access to an operating ship should be taken into consideration as an important part of the risk assessment. According to one report, attacks on software supply chains are up more than 300% in 2022 from the previous year. Cyber attacks on supply chains range from data hostage taking for financial gain to the theft of sensitive customer information. If they haven't already, companies in 2023 need to assess their digital supply chains for risk, prepare, and protect themselves from potential attacks.

Cybersecurity

As the e-commerce space continues to grow, returns management will also grow. Companies with high return rates will continue to look for ways to automate processes and reduce return costs, whether it be charging return shipping, limiting return periods, or partnering with multiple carrier options to ensure they pay the best price. Handling returned items will also be a challenge as the items may need to be routed to different locations depending on where they end up. We expect more companies to look for strategically located distribution centers in 2023 to receive and process returns. In 2023, there will also be an increase in the popularity of zone skips, or grouping many small parcels on the longest leg of transit before splitting into the last, shorter leg. One of the latest trends in the supply chain, kipping zones is currently underused, especially on land. But as shippers learn about the benefits, we expect to see. For companies that want to use zone skipping in their supply chain or improve their returns management process, partnering with third party logistics providers is usually the best choice.

For e-commerce brands, zone skipping and returns management will be key

Another important trend that we expect to continue and grow in 2023 will be sustainability. Changing consumer demands and tighter government regulation will continue to push companies towards greener practices in 2023. Companies will continue to seek and implement sustainable measures, from finding sustainable raw materials to estimating greenhouse gas emissions from transport. One notable example would be cyclical supply chains, where manufacturers reclaim discarded products to return or sell back to consumers. Whether they realize it or not, consumers will be buying more recycled and remanufactured goods in the coming years. Many of the future trends in supply chain management involve big changes, from new production sources to better technologies.

Consumer demands will increasingly include sustainability and circular supply chains

As environmental awareness grows around the world and consumers and corporations become more aware of their responsibility to reduce their overall carbon footprint, we are seeing increased attention to environmentally sound business and commercial practices.

With growing consumer preference for environmentally friendly products and services, coupled with a willingness to pay more for such products, sustainability has become a buzzword for large corporations. When selecting transport service providers (including shipping companies and domestic carriers), shippers and manufacturers around the world are paying more attention to reducing emissions and reducing their carbon footprint, as these aspects are given more weight in the annual tender process.

Governments and international trade and maritime organizations are also increasingly aware of the need for shipping to reduce emissions and are setting tough emission reduction targets. Major container carriers have gone even further and set emission reduction targets that are even more ambitious than the regulations allow. Carriers are also investing heavily in research to reduce emissions and are becoming open to investment in new technologies and fuels.

With growing consumer preference for environmentally friendly products and services, coupled with a willingness to pay more for such products, sustainability has become a buzzword for large corporations. When selecting transport service providers (including shipping companies and domestic carriers), shippers and manufacturers around the world are paying more attention to reducing emissions and reducing their carbon footprint, as these aspects are given more weight in the annual tender process.

Governments and international trade and maritime organizations are also increasingly aware of the need for shipping to reduce emissions and are setting tough emission reduction targets. Major container carriers have gone even further and set emission reduction targets that are even more ambitious than the regulations allow. Carriers are also investing heavily in research to reduce emissions and are becoming open to investment in new technologies and fuels.

Focus on the environment and green chains

A World Economic Forum analysis of emissions data provided by the International Maritime Organization found that ships account for 3.1% of global CO2 emissions per year.

The global shipping industry is seeking more clarity on the implementation of new ship carbon rating norms from next year amid fears it could lead to a series of ground-level complications and disruptions.

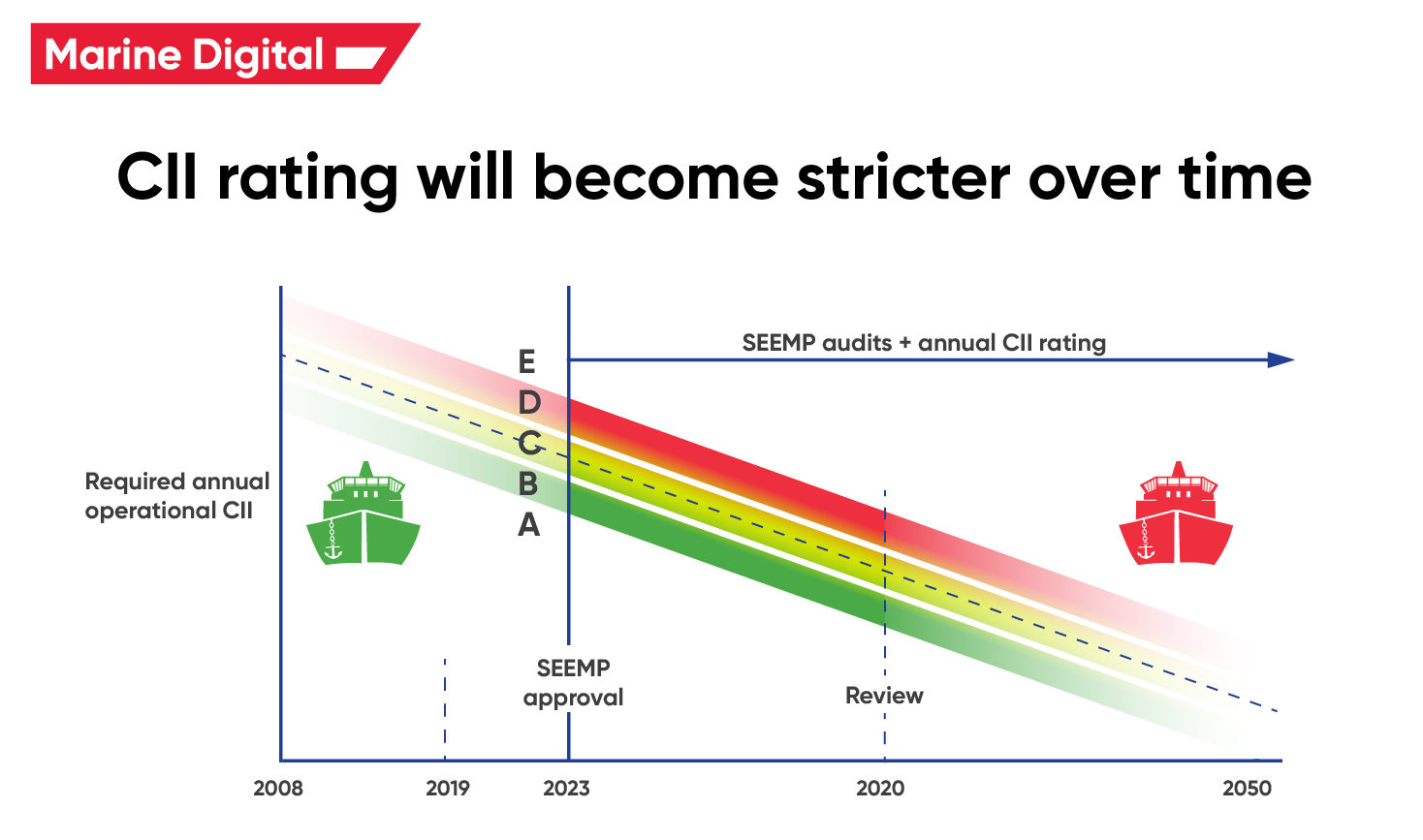

Less than 100 days before the implementation of the upcoming carbon intensity indicator, or CII, by the International Maritime Organization or IMO, industry players around the world are skeptical about its relevance and operational success unless these complexities are addressed soon. From January, all ships over 5,000 gross tonnage will be valued based on historical data. The CII measures carbon dioxide emissions per payload and nautical mile. Then the ship is assigned an annual rating from A to E, and the parameters will be tightened in stages. Ships rated 'D' within three years or rated 'E' within one year will be required to implement an Enhanced Ship Energy Efficiency Management Plan or SEEMP to reduce their emissions. The IMO aims to have the majority of the world's merchant fleet of more than 85,000 ships rated 'A' by 2025, with only a few 'B' or 'C' categories excluded. The CII is even more complex than the Existing Ship Energy Efficiency Index, or EEXI, and its implementation will require some adjustments between owners and charterers regarding contract terms.

In 2025, the IMO will conduct a review to adjust or adjust the CII to ensure that the maritime industry is on track to reduce carbon emissions by 70% from current levels by 2050. The maritime and shipping industry accounts for just 2% of global carbon emissions across all sectors.

New agreements and regulations from regulators and the growing interest of investors in supply chain efficiency can significantly change the industry, making indicators, benchmarking and strategy more transparent and accurate. and investors turned their attention to the most pressing issue of all: supply chains. This is one of the significant stumbling blocks for companies aiming for zero emissions, global climate change mitigation and sustainable investment decisions. As the bottleneck of global supply chains, maritime logistics has become a source of new risks for companies, investors and the planet in the coming decade.

Read more about The Shipping Industry: The greatest source of global carbon emissions?

The global shipping industry is seeking more clarity on the implementation of new ship carbon rating norms from next year amid fears it could lead to a series of ground-level complications and disruptions.

Less than 100 days before the implementation of the upcoming carbon intensity indicator, or CII, by the International Maritime Organization or IMO, industry players around the world are skeptical about its relevance and operational success unless these complexities are addressed soon. From January, all ships over 5,000 gross tonnage will be valued based on historical data. The CII measures carbon dioxide emissions per payload and nautical mile. Then the ship is assigned an annual rating from A to E, and the parameters will be tightened in stages. Ships rated 'D' within three years or rated 'E' within one year will be required to implement an Enhanced Ship Energy Efficiency Management Plan or SEEMP to reduce their emissions. The IMO aims to have the majority of the world's merchant fleet of more than 85,000 ships rated 'A' by 2025, with only a few 'B' or 'C' categories excluded. The CII is even more complex than the Existing Ship Energy Efficiency Index, or EEXI, and its implementation will require some adjustments between owners and charterers regarding contract terms.

In 2025, the IMO will conduct a review to adjust or adjust the CII to ensure that the maritime industry is on track to reduce carbon emissions by 70% from current levels by 2050. The maritime and shipping industry accounts for just 2% of global carbon emissions across all sectors.

New agreements and regulations from regulators and the growing interest of investors in supply chain efficiency can significantly change the industry, making indicators, benchmarking and strategy more transparent and accurate. and investors turned their attention to the most pressing issue of all: supply chains. This is one of the significant stumbling blocks for companies aiming for zero emissions, global climate change mitigation and sustainable investment decisions. As the bottleneck of global supply chains, maritime logistics has become a source of new risks for companies, investors and the planet in the coming decade.

Read more about The Shipping Industry: The greatest source of global carbon emissions?

Start of Mandatory CII(Carbon Intensity Indicator) Tracking

TOP 5 factors contributing to lower fuel costs for Shipping companies

Get a presentation with a full description of the features and free pilot project with trial of Marine Digital FOS for 2 months

"Clicking the button, you consent to the processing of personal data and agree to the privacy policy"

Get an overview "The Pathway to Zero Carbon Shipping:

IMO Compliance and CII Optimization through SEEMP" on email and download it for FREE! Leave your email now!

"Clicking the button, you consent to the processing of personal data and agree to the privacy policy, as well as consent to subscribe to the newsletter. "

Аdvantage of Fuel Optimization System from Marine Digital:

Marine Digital FOS can be integrated with other system and third-party's solutions through the API. To implement vessel performance monitoring for any vessel, we are using mathematical algorithms, machine learning and the same equipment as in FOS. The more data we collect from vessels, the more precise reports and recommendations our system will perform according to your individual requirements in fleet management.

If you have any questions about the solutions and the Marine Digital System platform, write to us, we will be happy to answer

If you have any questions about the solutions and the Marine Digital System platform, write to us, we will be happy to answer

Increased business process speed

Reducing to zero the number of errors

Best offer to the clients

Reduction in operating expenses

Have a questions?