How a Focus on ESG Transparency Will Impact Business

The current patchwork of largely voluntary ESG disclosure frameworks and a lack of accurate ESG data form an environment with a variety of interpretations of sustainability analysis and reports, misunderstandings of ESG data, average calculations of environmental impact, and hidden risks for business and investors. How will this situation be unfolding in the upcoming decades?

Growing climate warnings pushed regulators across the globe to revise ESG-data disclosure to reduce greenwashing and meet demand from investors to get a trustful assessment of their green portfolio.

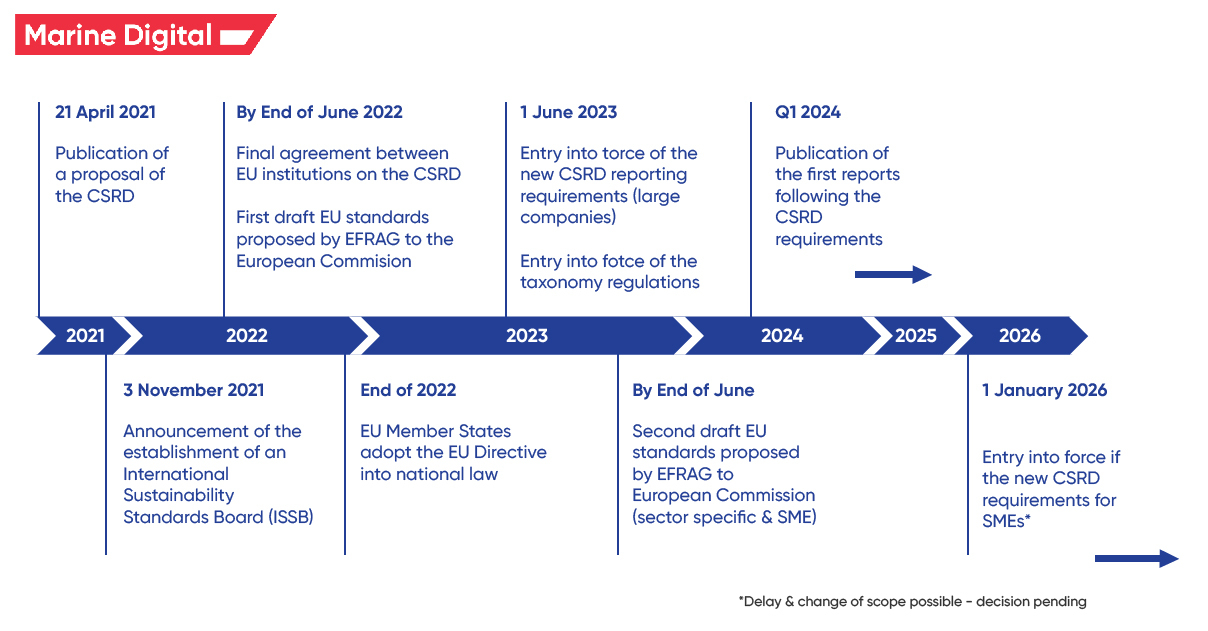

In Europe, companies have already been required to report ESG data in the Non-Financial Reporting Directive since 2018. Meanwhile, the implementation of the Corporate Sustainability Reporting Directive (CSRD) from 2023 will improve and replace the current NFRD, which applies to approximately 12.000 organizations within the EU region. The new directive applies to a drastically larger scope of companies (49.000 companies more) across all sectors.

The main goal of the directive is to enable companies to meet the growing demand for sustainability reporting in a cost-efficient manner and the first set of reporting standards highly focuses on double materiality, which encompasses how sustainability issues affect the company, and on the company's impact on society and the environment.

In Europe, companies have already been required to report ESG data in the Non-Financial Reporting Directive since 2018. Meanwhile, the implementation of the Corporate Sustainability Reporting Directive (CSRD) from 2023 will improve and replace the current NFRD, which applies to approximately 12.000 organizations within the EU region. The new directive applies to a drastically larger scope of companies (49.000 companies more) across all sectors.

The main goal of the directive is to enable companies to meet the growing demand for sustainability reporting in a cost-efficient manner and the first set of reporting standards highly focuses on double materiality, which encompasses how sustainability issues affect the company, and on the company's impact on society and the environment.

New ESG Transparency Rules

Consistent ESG reporting is essential to hold companies more accountable to their net zero pledges. Disclosing emissions data across Scope 1, 2 and 3 of GHG Protocol, enterprises can get a clear picture that some are less competitive versus peers and search for decarbonization plans and approaches to lower their carbon footprint. At the same time, for investors, this is a source to decipher how green their investments truly are and assess how portfolios are meeting imposed targets.

Accurate footprint insights allow companies to create shared value business collaboration in supply chains that account for more than 80% of the environmental impact. This percentage might seem dramatic – but it also leads to many opportunities for businesses to essentially reduce negative impact.

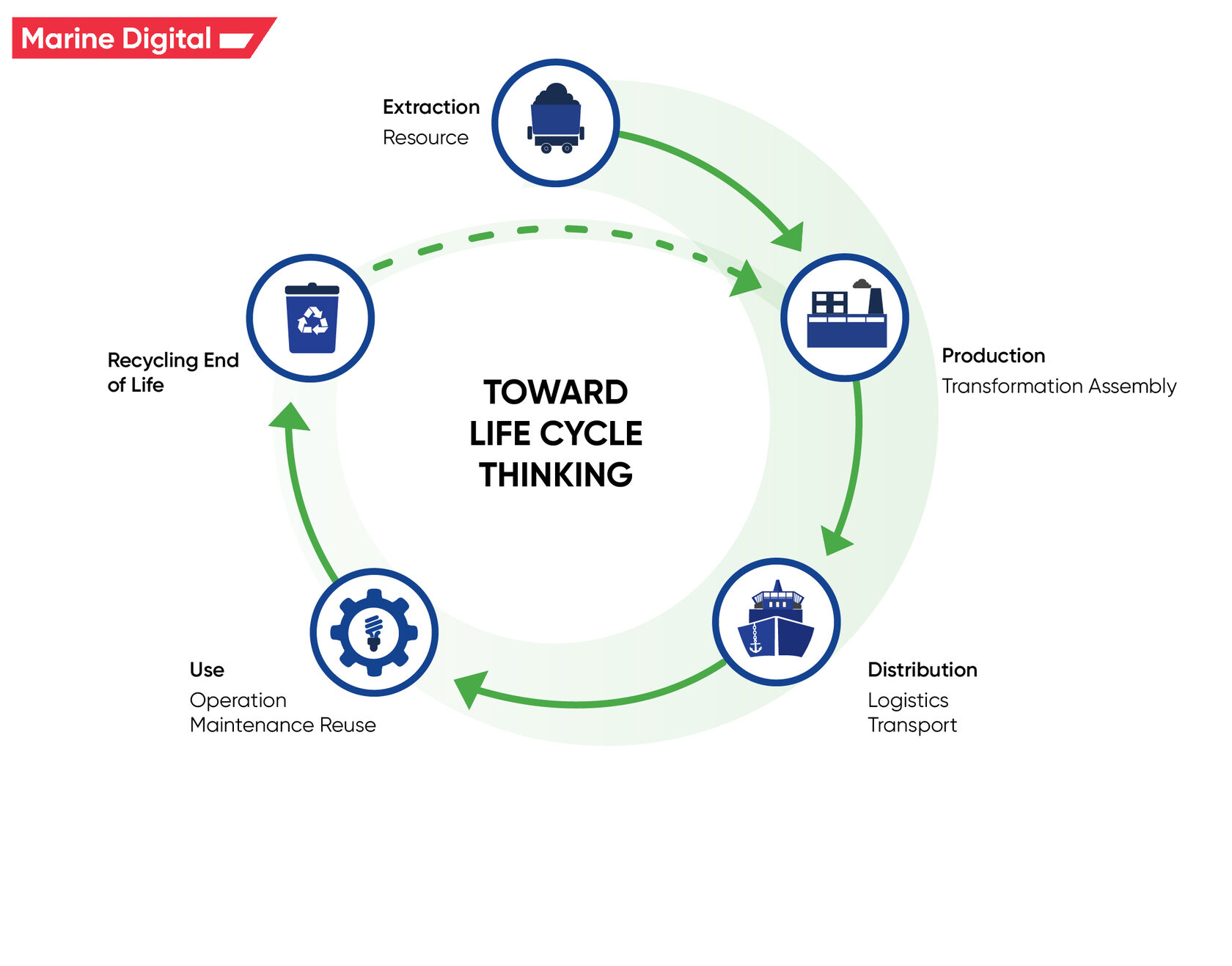

As the first step to building valuable collaboration with suppliers that can lead to improved products and/or services, businesses often start from data collection in measuring an LCA, or a Life Cycle Inventory. Meanwhile, the first LCA calculation is based on already existing (average) environmental background data on supply chains. So it allows to get an overview of environmental hotspots within the supply chain but can never be a credible source for making procurement decisions, setting up decarbonization plans and designing sustainability strategies.

As the first step to building valuable collaboration with suppliers that can lead to improved products and/or services, businesses often start from data collection in measuring an LCA, or a Life Cycle Inventory. Meanwhile, the first LCA calculation is based on already existing (average) environmental background data on supply chains. So it allows to get an overview of environmental hotspots within the supply chain but can never be a credible source for making procurement decisions, setting up decarbonization plans and designing sustainability strategies.

An Impulse To Valuable Collaborations With Suppliers

To have accurate and trusted analytics companies need to require raw data from suppliers, so-called 'primary data'. A product LCA is a key to have all the information to measure the environmental footprint as well as share these insights with suppliers to help them be precise with their own footprint too. And this is one of the hardest-to-tackle parts of the processes when it comes to transportation and logistics, especially in maritime supply chains. While 9 out of 10 goods we use in daily life are delivered by sea, it means that almost every large corporate company uses ocean shipping. Next, we will look at the main obstacles getting maritime logistics and transportation data and the ways to overcome it.

In the next step, a company is able to create shared value with suppliers and build a decarbonization strategy. Building a long-term relationship with key-suppliers create much more opportunities for improving sustainability strategies for both players and decarbonize all thought supply chains, as well as develop new formats and processes to build a sustainable economy and run the business in the future. But, first – data.

In the next step, a company is able to create shared value with suppliers and build a decarbonization strategy. Building a long-term relationship with key-suppliers create much more opportunities for improving sustainability strategies for both players and decarbonize all thought supply chains, as well as develop new formats and processes to build a sustainable economy and run the business in the future. But, first – data.

In the maritime industry, vessel fuel efficiency and emission data is not public and is not accurate because 80% of the global fleet are non-digital vessels with manual reporting. Therefore, in most cases there are fragmented, and sometimes out-of-date data sets from across their operations. Without a comprehensive picture of operational performance – including emissions and fuel usage – it is almost impossible to calculate environmental impact (please, be aware that averages don't work for ESG analytics in the maritime supply chains!), identify where adjustments need to be made for improving energy-efficiency and the best way of approaching them with decarbonization strategy.

This challenge is also seen more broadly throughout shipping's wider eco-system with cargo owners, logistic companies, as well as banks and asset managers. All these stakeholders are unable to make an accurate analysis of companies' ESG performance because of a lack of cohesive, transparent, and up-to-date information. Therefore, absence of data transparency leads to the negative impact on the ability of operational planning for surrounding industries such as automotive manufacturing, e-commerce, pharmacy, space industry, food, etc., - and the damage is estimated in dozens billions of dollars annually.

That's why lots of companies today choose Marine Digital solutions to analyze, monitor and reduce GHG emissions & carbon footprint and measure energy efficiency in marine transportation and logistics, bringing granular visibility of carbon emissions across the value chain as well as assess environmental and economic risks for business sustainability. Accumulating one of the most complex data sets in the industry and applying digital twin technology powered with AI algorithms, we are able to ensure the most accurate analytics, to identify bottlenecks of the maritime logistics and assess environmental and economic risks for business sustainability. To learn more about our ESG Solution please follow the link.

This challenge is also seen more broadly throughout shipping's wider eco-system with cargo owners, logistic companies, as well as banks and asset managers. All these stakeholders are unable to make an accurate analysis of companies' ESG performance because of a lack of cohesive, transparent, and up-to-date information. Therefore, absence of data transparency leads to the negative impact on the ability of operational planning for surrounding industries such as automotive manufacturing, e-commerce, pharmacy, space industry, food, etc., - and the damage is estimated in dozens billions of dollars annually.

That's why lots of companies today choose Marine Digital solutions to analyze, monitor and reduce GHG emissions & carbon footprint and measure energy efficiency in marine transportation and logistics, bringing granular visibility of carbon emissions across the value chain as well as assess environmental and economic risks for business sustainability. Accumulating one of the most complex data sets in the industry and applying digital twin technology powered with AI algorithms, we are able to ensure the most accurate analytics, to identify bottlenecks of the maritime logistics and assess environmental and economic risks for business sustainability. To learn more about our ESG Solution please follow the link.

Maritime Supply Chains Transparency

A high demand for ESG transparency from regulators, investors and customers is now reshaping the industry and the ripple effect is being felt along supply chains, influencing supplier and customer relationships, and boosting new commercial thinking.

For long decades, the burden to solve the climate crisis has been on governments. But with clear regulatory frameworks in sight and implementation of tools to derive primary ESG data, the baton can be passed to business, which has always been a driver for change and collective impact and has far greater leverage to dedicate to the sustainability transition. With this strong focus on the ESG visibility of the global footprint, including operations, logistics, and supply chains, we will witness a dramatic transformation of operational insights into business opportunities.

Summary

Get an overview "The Pathway to Zero Carbon Shipping:

IMO Compliance and CII Optimization through SEEMP" on email and download it for FREE! Leave your email now!

"Clicking the button, you consent to the processing of personal data and agree to the privacy policy, as well as consent to subscribe to the newsletter. "

Аdvantage of Fuel Optimization System from Marine Digital:

Marine Digital FOS can be integrated with other system and third-party's solutions through the API. To implement vessel performance monitoring for any vessel, we are using mathematical algorithms, machine learning and the same equipment as in FOS. The more data we collect from vessels, the more precise reports and recommendations our system will perform according to your individual requirements in fleet management.

If you have any questions about the solutions and the Marine Digital System platform, write to us, we will be happy to answer

If you have any questions about the solutions and the Marine Digital System platform, write to us, we will be happy to answer

Increased business process speed

Reducing to zero the number of errors

Best offer to the clients

Reduction in operating expenses

Have a questions?