ESG Reporting: What You Need To Know

The growing importance of ESG reports is supported by the fact that the investors and other stakeholders are calling on companies to disclose more about their sustainability and environmental, social, and governance strategies

"Although 92% of S&P companies were reporting ESG metrics by the end of 2020, according to a 2020 BlackRock survey of clients, 53% of global respondents cited "poor quality or availability of ESG data and analytics" and another 33% cited "poor quality of sustainability investment reporting" as the two biggest barriers to adopting sustainable investing". (BlackRock, Sustainability goes mainstream: 2020 Global Sustainable Investing Survey)

An ESG report is a report published by a company or organization about environmental, social and governance (ESG) impacts. It discloses data covering the company's operations in three areas: environmental, social and corporate governance. It is often seen as a strategic tool that helps to communicate a company's dedication to making the world a better place.

ESG and Carbon reporting has become a strategic necessity for most companies following the growing interest of investors, CFOs and other stakeholders in accurate, trusted, and timely emissions data to build a sustainabile economy and environmental, social, and governance strategies

By encompassing both qualitative disclosures of topics as well as quantitative metrics, an ESG report enables companies to measure their performance against ESG risks and transform operational insights into business opportunities.

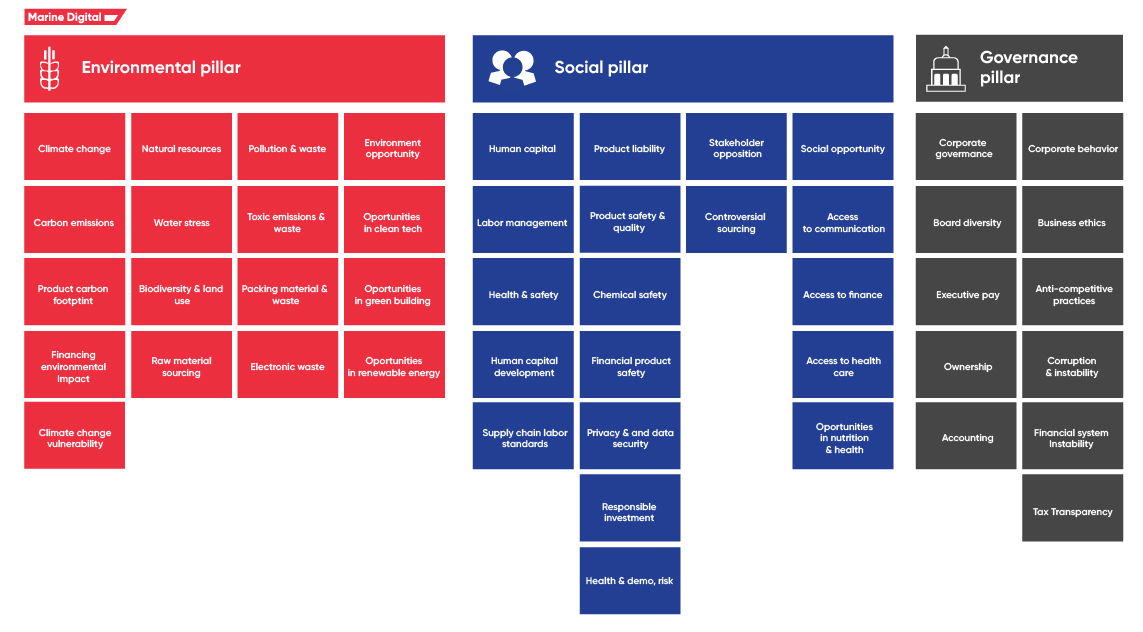

To break it down, ESG reporting should feature information on the following:

An ESG report is a report published by a company or organization about environmental, social and governance (ESG) impacts. It discloses data covering the company's operations in three areas: environmental, social and corporate governance. It is often seen as a strategic tool that helps to communicate a company's dedication to making the world a better place.

ESG and Carbon reporting has become a strategic necessity for most companies following the growing interest of investors, CFOs and other stakeholders in accurate, trusted, and timely emissions data to build a sustainabile economy and environmental, social, and governance strategies

By encompassing both qualitative disclosures of topics as well as quantitative metrics, an ESG report enables companies to measure their performance against ESG risks and transform operational insights into business opportunities.

To break it down, ESG reporting should feature information on the following:

Environmental performance: A company's impact on the environment and its ability to mitigate various risks that could harm the environment. It considers how a company uses resources across the board — Scope 1 to Scope 3. This may include a company's carbon footprint as well as its record regarding energy efficiency, waste management, conservation of water and other natural resources, and biodiversity.

Social impacts: Assesses a company's relationships with other businesses, its standing in the local community, its commitment to diversity and inclusion among its workforce and board of directors, its charitable contributions, and whether it is noted for employee policies that foster health and safety, data protection and security.

Corporate governance: Assesses a company's internal processes, such as transparent accounting methods, executive compensation, and board composition, as well as its relationships with employees and stakeholders. It may also include internal regulations designed to prevent conflicts of interest and unethical behavior, tax transparency, corruption and instability.

Social impacts: Assesses a company's relationships with other businesses, its standing in the local community, its commitment to diversity and inclusion among its workforce and board of directors, its charitable contributions, and whether it is noted for employee policies that foster health and safety, data protection and security.

Corporate governance: Assesses a company's internal processes, such as transparent accounting methods, executive compensation, and board composition, as well as its relationships with employees and stakeholders. It may also include internal regulations designed to prevent conflicts of interest and unethical behavior, tax transparency, corruption and instability.

The future of ESG is promising and challenging. Incorporating ESG into corporate reporting and business strategy is a powerful tool for gaining a competitive advantage, strengthening internal operations and maintaining a good relationship with investors and other stakeholders. In fact, since July 2020 about 90% of the companies in the S&P 500 have already created annual ESG reports and made it a standard.

ESG and Carbon reporting has become a tool that combines sustainability goals with higher profits and, in some cases, market capitalization. Therefore, proactive and future-focused companies understand the importance of communicating ESG performance in their business strategy to address the urgent need of investors, regulators, customers and other stakeholders in assessing whether businesses have successfully identified and are managing ESG risks.

Meanwhile, developing a strategic approach to ESG can be challenging because of the various and different standards of reporting and gaps in the existing ESG standard setters. Scoring is opaque and non-comparable because ratings are based on different criteria plucked from frameworks set out by multiple standard-setting regulators. Not surprisingly, the "lack of reporting standards" was cited as a top barrier to ESG effectiveness by executives.

ESG and Carbon reporting has become a tool that combines sustainability goals with higher profits and, in some cases, market capitalization. Therefore, proactive and future-focused companies understand the importance of communicating ESG performance in their business strategy to address the urgent need of investors, regulators, customers and other stakeholders in assessing whether businesses have successfully identified and are managing ESG risks.

Meanwhile, developing a strategic approach to ESG can be challenging because of the various and different standards of reporting and gaps in the existing ESG standard setters. Scoring is opaque and non-comparable because ratings are based on different criteria plucked from frameworks set out by multiple standard-setting regulators. Not surprisingly, the "lack of reporting standards" was cited as a top barrier to ESG effectiveness by executives.

Why ESG Reporting is Essential For Business

There's more than one way to report your ESG disclosures. As interest in ESG performance has grown, the number of ESG frameworks has risen too.

Here are the key ones to know.

In April 2021, the EU Commission presented a new proposal for The Corporate Sustainability Reporting Directive which extends the scope and reporting requirements of the already existing Non-Financial Reporting Directive – a regulatory framework that mandates sizeable public interest entities to report on their sustainability performance since 2018.

While the NFRD only requires "public interest entities" with more than 500 employees to report on their sustainability performance, the CSRD will require all large companies – meaning companies with more than 250 employees and more than €40M turnover and/or more than €20 Million in total assets – and all listed companies (except micro-enterprises, less than 10 employees or below €20M in turnover) to report on their sustainability.

As soon as put into force, nearly 50,000 companies (15,000 in Germany alone) in the EU will need to follow detailed EU sustainability reporting standards, corresponding to 75% of all EU companies turnover.

Additional to the NFRD Under Directive 2014/95/EU, large companies have to publish information related to:

Businesses will have to start reporting on how sustainability risks might affect their performance. The NFR Directive is a leading example of how the landscape of managing and disclosing non-financial risks has changed – and continues to change. The evolution of accountability shows us it is only a matter of time before prominent voluntary initiatives will become mandatory regulations, and as such being ahead of the curve will help businesses mitigate any backlash.

Here are the key ones to know.

- Non-Financial Reporting Directive (NFRD): This requires companies to make a series of disclosures and publish regular reports on their activities' social and environmental impacts.

- The Sustainable Finance Disclosure Regulation (SFDR): aims to provide more transparency on sustainability within the financial markets in a consistent manner to ensure comparability.

- EU Taxonomy Regulation: published in 2020 which established a classification system for environmentally sustainable economic activities. It provides appropriate definitions for companies, investors, and policymakers whose economic activities can be environmentally sustainable.

In April 2021, the EU Commission presented a new proposal for The Corporate Sustainability Reporting Directive which extends the scope and reporting requirements of the already existing Non-Financial Reporting Directive – a regulatory framework that mandates sizeable public interest entities to report on their sustainability performance since 2018.

While the NFRD only requires "public interest entities" with more than 500 employees to report on their sustainability performance, the CSRD will require all large companies – meaning companies with more than 250 employees and more than €40M turnover and/or more than €20 Million in total assets – and all listed companies (except micro-enterprises, less than 10 employees or below €20M in turnover) to report on their sustainability.

As soon as put into force, nearly 50,000 companies (15,000 in Germany alone) in the EU will need to follow detailed EU sustainability reporting standards, corresponding to 75% of all EU companies turnover.

Additional to the NFRD Under Directive 2014/95/EU, large companies have to publish information related to:

- Environmental protection

- Social responsibility and treatment of employees

- Respect for human rights

- Anti-corruption and bribery and

- Diversity on company boards

- Double materiality concept: Sustainability risk (including climate change) affecting the company + companies' impact on society and environment

- Process to select material topics for stakeholders

- More forward looking information, including targets and progress

- Disclose information relating to intangibles (social, human and intellectual capital)

- Reporting in line with Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation

Businesses will have to start reporting on how sustainability risks might affect their performance. The NFR Directive is a leading example of how the landscape of managing and disclosing non-financial risks has changed – and continues to change. The evolution of accountability shows us it is only a matter of time before prominent voluntary initiatives will become mandatory regulations, and as such being ahead of the curve will help businesses mitigate any backlash.

Regulations lead towards mandatory reporting on ESG

Currently, companies have a long leash when it comes to ESG disclosure. In many cases they are free to present ESG information in a way they consider to be most useful. That said, the use of recognized frameworks is recommended. Here are just a few:

Global Reporting Initiative (GRI) is a framework that helps companies disclose both the positive and negative impact their business has on the environment, the economy, and society. GRI's focus is on helping companies communicate their ESG impacts and how they manage these impacts. GRI is the most referenced ESG framework among all industries, receiving 83% of total references to ESG frameworks.

The Sustainability Accounting Standards Board (SASB) are a set of standards that help companies collect and share ESG data that affect the firm's business decisions and explain the financial impact of sustainability. It's worth noting that the GRI and SASB joined forces in 2020 and have since published a guide to how organizations can use the two standards together. GRI is known for its high-level scope, while SASB gives companies industry-specific guidelines using a financial lens.

The Task Force on Climate-related Financial Disclosures (TCFD) is a framework that provides principles-based recommendations for managing and reporting focused primarily on climate risks. It focuses most on financial risk disclosures associated with climate to aid banks, shareholders and investors scrutinize an organization's ESG efforts.

Carbon Disclosure Project (CDP) is an international non-profit focused on creating standards that companies can use to disclosure information pertaining to GHG emissions, water use, and forestry. This set of standards has helped companies as well as city, state and regional government organizations disclose decarbonization and environmental protection efforts.

Streamlined Energy and Carbon Reporting (SECR) is a framework created by the UK Government that guides organizations on how to report on their carbon emissions and energy usage on an annual basis. The goal of the framework is to streamline existing carbon reporting frameworks for greater transparency and comparability, while making it easier for companies to monitor and reduce their carbon emissions.

The Workforce Disclosure Initiative (WDI) is an investor collective that formed to help companies communicate labour practices to stakeholders. It aims to improve transparency and accountability on workforce issues by providing companies with a framework for disclosing comprehensive and comparable workforce data.

Read more about ESG Reporting And Analytics For Marine Supply Chains

Global Reporting Initiative (GRI) is a framework that helps companies disclose both the positive and negative impact their business has on the environment, the economy, and society. GRI's focus is on helping companies communicate their ESG impacts and how they manage these impacts. GRI is the most referenced ESG framework among all industries, receiving 83% of total references to ESG frameworks.

The Sustainability Accounting Standards Board (SASB) are a set of standards that help companies collect and share ESG data that affect the firm's business decisions and explain the financial impact of sustainability. It's worth noting that the GRI and SASB joined forces in 2020 and have since published a guide to how organizations can use the two standards together. GRI is known for its high-level scope, while SASB gives companies industry-specific guidelines using a financial lens.

The Task Force on Climate-related Financial Disclosures (TCFD) is a framework that provides principles-based recommendations for managing and reporting focused primarily on climate risks. It focuses most on financial risk disclosures associated with climate to aid banks, shareholders and investors scrutinize an organization's ESG efforts.

Carbon Disclosure Project (CDP) is an international non-profit focused on creating standards that companies can use to disclosure information pertaining to GHG emissions, water use, and forestry. This set of standards has helped companies as well as city, state and regional government organizations disclose decarbonization and environmental protection efforts.

Streamlined Energy and Carbon Reporting (SECR) is a framework created by the UK Government that guides organizations on how to report on their carbon emissions and energy usage on an annual basis. The goal of the framework is to streamline existing carbon reporting frameworks for greater transparency and comparability, while making it easier for companies to monitor and reduce their carbon emissions.

The Workforce Disclosure Initiative (WDI) is an investor collective that formed to help companies communicate labour practices to stakeholders. It aims to improve transparency and accountability on workforce issues by providing companies with a framework for disclosing comprehensive and comparable workforce data.

Read more about ESG Reporting And Analytics For Marine Supply Chains

ESG Reporting Standards

ESG Report And Analytics

Online Dashboard

Suppliers Performance Evaluation

Supply Chain Decarbonization Plan

Supply Chain Sustainability Monitoring

Get Full Description and FREE Trial

Suppliers Performance Evaluation

Supply Chain Decarbonization Plan

Supply Chain Sustainability Monitoring

Get Full Description and FREE Trial

Get an overview "The Pathway to Zero Carbon Shipping:

IMO Compliance and CII Optimization through SEEMP" on email and download it for FREE! Leave your email now!

"Clicking the button, you consent to the processing of personal data and agree to the privacy policy, as well as consent to subscribe to the newsletter. "

Аdvantage of Fuel Optimization System from Marine Digital:

Marine Digital FOS can be integrated with other system and third-party's solutions through the API. To implement vessel performance monitoring for any vessel, we are using mathematical algorithms, machine learning and the same equipment as in FOS. The more data we collect from vessels, the more precise reports and recommendations our system will perform according to your individual requirements in fleet management.

If you have any questions about the solutions and the Marine Digital System platform, write to us, we will be happy to answer

If you have any questions about the solutions and the Marine Digital System platform, write to us, we will be happy to answer

Increased business process speed

Reducing to zero the number of errors

Best offer to the clients

Reduction in operating expenses

Have a questions?